I can get a feel for financial market trends based on the lines at macaroon stores. The 2015/2016 Macaroon Trend tells me Asia is hunkering down for a multi-year recession (unless Sugar Daddy Xi Jinping saves us with a trillion dollar spending spree on SE Asia infrastructure). Certainly I’m seeing a consistent trend of slashed bonuses, and for the wiser of those living an inflated lifestyle off income from structured deposits – you know a day of reckoning is near.

So it’s no surprise that over 50% of client queries since January asked me to help with this question, “Where Is All My Money Going?!” This is better known as a cashflow problem, and it is Ground Zero in your battle to build long-term financial stability and its close cousin, wealth. The root of the problem usually exists in one of these three categories:

- Habits: Spending to Pretend

- Mindset: Inflation and Investing

- Leadership: Lack of Household Financial Leadership

Spending to Pretend

Bragging rights spending and/or indulging in an uninterrupted life of self-absorption is often masking an unmet psychological issue which can lead to cashflow problems. And when spending is used to compensate for loneliness or to fit in to a group, your 'Need to Belong' can reinforce financially destructive spending patterns.

Belonging issues are exacerbated in expatriate communities; people do all sorts of things with money that they’d never consider otherwise to feel they belong and/or project an image of success. Spending is reinforced by group-think and rationalized as “You only live once”, a refrain uniquely common among teenage snowboarders and adult expats.

So, if you are spending like there’s no tomorrow and have very little set aside for retirement or emergencies, work through these questions:

- How much is it costing me per year to appear to “belong” or to project an image that is in contrast with how much I have?

- Why are my strategies to belong overwhelming my finances and what is the root of my loneliness?

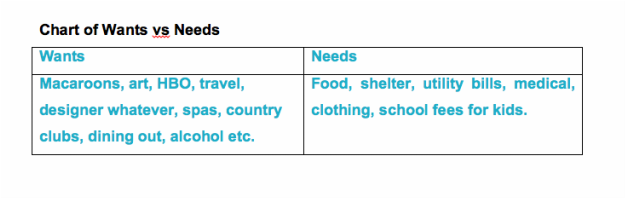

- How can I differentiate between wants and needs so that I can enable myself to save 20% of my salary a month?

Inflation and Investing

This conversation goes something like, “I make good money but my savings will never be enough for what I want.” Here there is usually a lack of awareness around what happens to the purchasing power of un-invested savings. Or put simply, US$1MM today will only buy you US$667,000 in 20 years if inflation is 2% per year. So, yes your money is melting.

Inflation in the things that matter ie expenses from medical care to food to school fees might taper off but it’s not going away. To beat inflation you need to a) save more than inflation will devour and/or b) invest at a rate that is greater than inflation after fees are accounted for. So the only questions you should be working through are as follows:

- What are my financial goals?

- How do I save and/or invest efficiently to meet those goals?

If you do not want to invest or save, make peace with having less.

Household Financial Leadership

You might be saving or investing in an ad-hoc way, but no one has a plan and no one is communicating around finances in a household. This is a very common issue in families, and it’s easy to solve with the right ‘money language’ and tools.

Someone has to be designated or designate themselves as the Household CFO – by constructing a budget and a balance sheet and investing regularly against a plan. Decisions around saving and investing are made jointly and transparently with respect to the wishes and concerns of others, but that person is the Family Money Grand Poobah (it could be Wilma).

If conversations around money are hard, involve a third party such as a Certified Financial Planner (CFP) who is trained to create comprehensive financial plans, estate plans and investment plans. The best CFPs are trained to be Money Therapists and they’ll help your family improve communication around money. As a CFP and Money Therapist, I’ve never met a spouse who said hiring one was “a bad idea” unless there was something to hide.

The bottom line is this: Financial stability and security are in the reach for anyone who can live below their means and invest regularly. It is that simple.